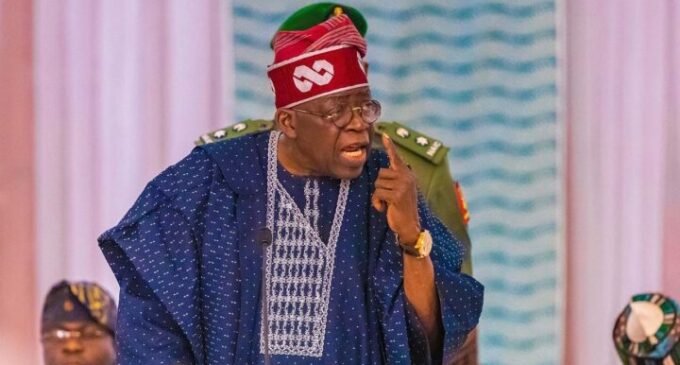

President Bola Tinubu has pledged to put an end to Nigeria’s heavy reliance on borrowing for funding public expenditures.

He made this commitment on Tuesday during the inauguration of the presidential committee on fiscal policy and tax reforms.

The committee, established on July 7, 2023, is headed by Taiwo Oyedele, an esteemed expert in tax and fiscal policy.

This committee comprises professionals from both the private and public sectors. Their responsibilities span tax law reforms, fiscal policy design and coordination, harmonization of taxes, and revenue administration.

During the event, President Tinubu reaffirmed that the committee’s creation aligns with his promise to eliminate any obstacles hindering business growth in Nigeria.

He said:

“The consequences of the ongoing failure of our tax regime are real and significant. The inability of the government to efficiently raise revenue has led directly to an overreliance on borrowing to finance public spending,” Tinubu said.

“A government that cannot properly fund itself will also lack the flexibility or fiscal scope to sensibly manage the economy or respond to external shocks.

“Instead, debt service begins to consume an ever greater portion of the government’s already meagre revenues.

“This traps the economy in a vicious cycle of borrowing simply to service previous debt and leaves almost no scope for socio-economic development.

“As President, I am determined to end this cycle. I promised that my administration would address all of the issues impeding investment and economic growth in Nigeria. This promise is why I saw an end to the fuel subsidy. It is the reason the Central Bank has called an end to its multiple exchange rate system under my watch.

“It is for the same reason we gather here today to inaugurate the Presidential Committee on Fiscal Policy and Tax Reforms.”

Zacchaeus Adedeji, special adviser to the president on revenue, highlighted that the committee’s inauguration provides an avenue to enhance interactions with different stakeholders.

This engagement aims to pinpoint their grievances and significant issues related to tax and fiscal policies.

The goal is to collaboratively formulate comprehensive solutions to tackle challenges.

Also addressing the gathering, Oyedele noted that individuals who evade taxes often do so with minimal repercussions.

He emphasized the necessity for a shift in this pattern.

Oyedele stated that Nigerians are inclined to fulfill their tax obligations if they observe tangible outcomes resulting from it.