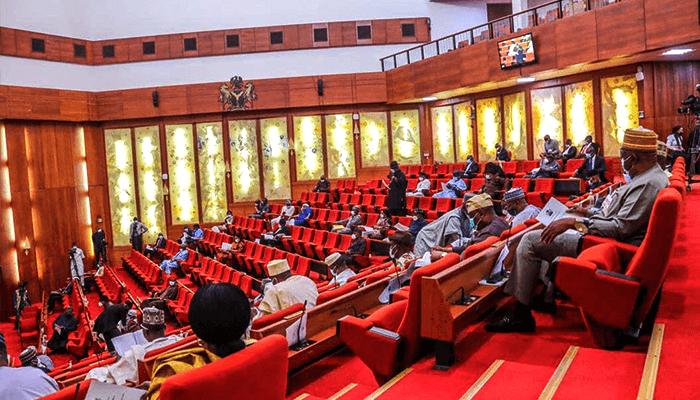

On Thursday, the Senate passed the four tax bills for a second reading.

President Tinubu Bola transmitted the four tax reform bills to the National Assembly for consideration on October 3, including the Nigeria Tax Bill 2024, the Tax Administration Bill, and the Nigeria Revenue Service Establishment Bill, meant to repeal the Federal Inland Revenue Service (FIRS) Act and create the Nigeria Revenue Service (NRS) and, the Joint Revenue Board Establishment Bill saying their passage will bring the country economic prosperity.

Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, had earlier in the week briefed Senators about how passage of the bills will transform Nigeria into an economic powerhouse.

The move generated controversy with the Northern governors and other stakeholders kicking against the tax reforms. Worried by the situation, the Presidency explained that the bills were not targeted at any particular region but to develop the country.