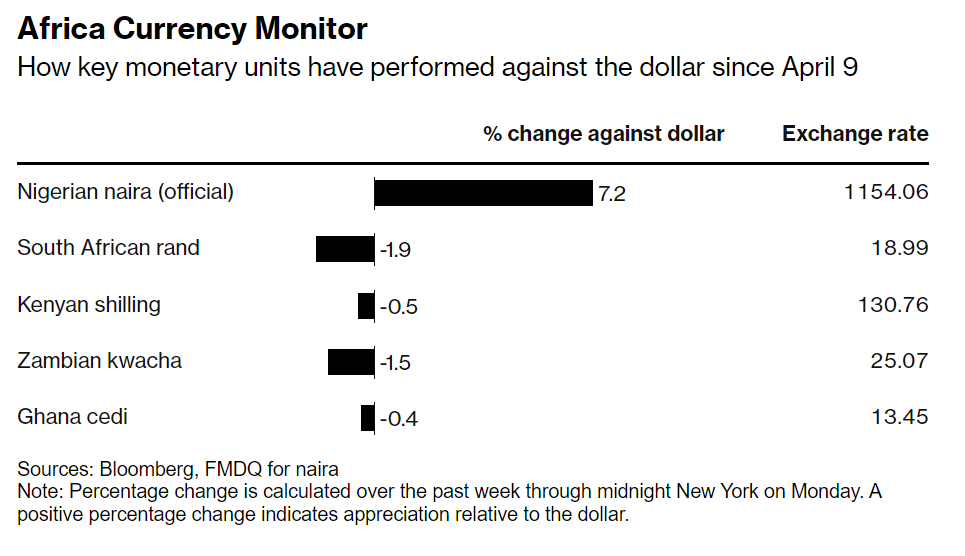

In a dramatic turn of events, the Nigerian Naira has plummeted from being one of the best-performing currencies earlier this year to the worst-performing currency globally in April, as reported by Bloomberg.

This decline exposes the volatility of the Naira and why the government must adopt sustainable policies to stabilise it.

The parallel market and speculators

Naira’s freefall can be attributed to several factors, one of which is the parallel market and speculators.

The parallel market, popularly referred to as the black market, has a huge impact on the official exchange rates. The naira’s recent fall to a one-month low of 1,500 against the dollar on the parallel market is an indicator of the severe dollar shortage and the negative influence of speculators.

In an economy where the official exchange rate is controlled and often unrealistic, the parallel market provides a more accurate reflection of the naira’s true value. Speculators exploit the discrepancies between the official and parallel market rates.

In addition, the increase in demand for foreign currency for essential services such as overseas education, healthcare, and tourism, the majority of which are sourced from the black market, amplifies this effect, putting additional pressure on the naira.

Economic mismanagement

Despite being Africa’s largest economy, Nigeria continues to struggle with a lack of diversification, majorly depending on crude oil exports for revenue. This dependency makes the economy vulnerable to fluctuations in global oil prices.

The recent decline in oil prices has thus significantly affected Nigeria’s foreign exchange earnings, leading to a shortage of dollars and exacerbating the naira’s depreciation.

Inflation and public confidence in the Naira

Inflation remains another critical factor undermining the naira. Nigeria’s inflation rate has been consistently high, reducing the purchasing power of the Naira. According to recent data released by the National Bureau of Statistics (NBS), inflation rose to 33.69 per cent in April 2024.

Public confidence in the naira is reducing, as evidenced by the increasing demand for the dollar and other foreign currencies.

According to reports, there are concerns that some state governors illegally convert funds from the Federation Account Allocation Committee (FAAC) allocated to them to dollar at the unofficial market rate.

Leaders who are supposed to set the pace for the populace to follow have continually failed in this regard. This lack of confidence is a self-perpetuating cycle; as more people lose faith in the naira and seek refuge in foreign currencies, the naira continues to weaken.

Way forward

Addressing the naira’s downward trend requires a multifaceted approach. First, there is a need for economic diversification.

Reducing the over-reliance on crude oil and promoting investments in other sectors such as agriculture, manufacturing, and technology can help stabilise and boost our foreign exchange earnings.

Also, structural reforms are necessary. Improving infrastructure, enhancing security, and creating a more conducive environment for business and foreign investments can help tackle the root causes of inflation and economic instability.