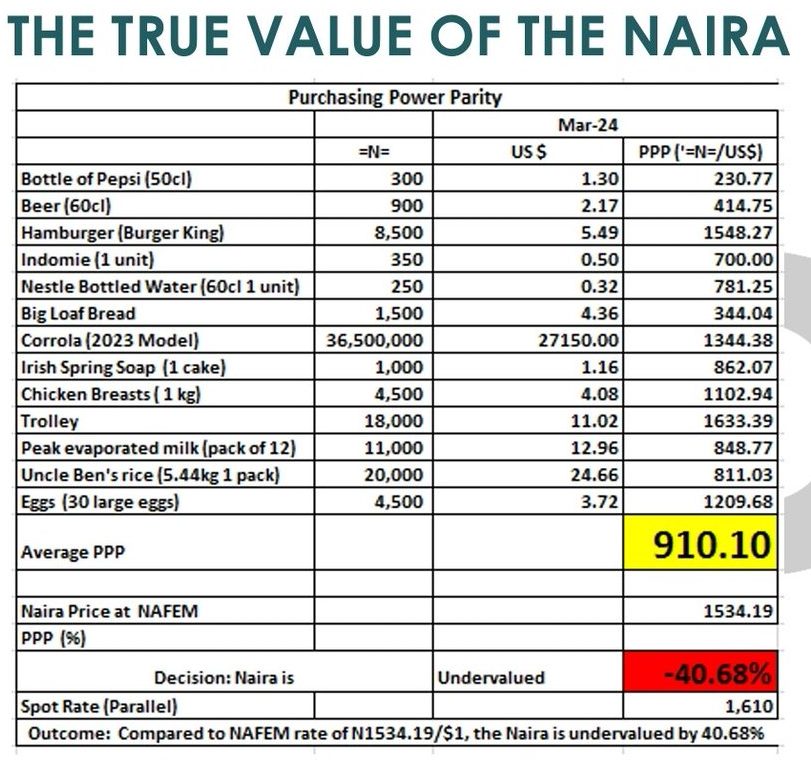

A recent analysis by the Financial Derivatives Company (FDC), has revealed that the true value of the Nigerian Naira stands at N910 against the US dollar, significantly lower than its official rate.

This staggering undervaluation amounts to approximately 41 per cent, indicating deep-rooted challenges within Nigeria’s economic landscape.

In the first quarter of 2024 alone, the Naira has depreciated by 17 per cent, following a 39 per cent decline in 2023. This downward trajectory has seen the official exchange rate plummet to a record low of N1450/$, compared to N490/$ in 2016.

The decline of the Naira can be traced to a culmination of years of imbalance in the foreign exchange market, compounded by various economic factors.

Naira’s downward spiral can also be attributed to a myriad of issues, including rising inflation and high cost-of-living crisis.

According to the FDC, key drivers of the Naira’s fall include scarcity of dollars, dwindling confidence in the Naira, speculative trading, and restrictive exchange controls. Structural issues such as declines in crude oil output due to theft and vandalism have also hampered potential dollar earnings.

Various methodologies have been employed to determine the true value of the Naira, with a recent publication from the FDC indicating that the true value of the Naira is N910/USD.

Addressing the Naira’s challenges requires a multifaceted approach. Rebuilding confidence in the foreign exchange markets is paramount, alongside aligning interest rates with inflation to narrow negative real rates of return. The Central Bank of Nigeria (CBN) should also consider implementing an open auction system to foster a more transparent and competitive FX market.

While the apex bank maintains that the Naira should trade at N850/$, proactive measures are imperative to achieve this target. It is evident that urgent and decisive action is needed to address the underlying issues plaguing the Naira and steer Nigeria’s economy towards stability and growth.