The Central Bank of Nigeria (CBN) has withdrawn its earlier directive mandating banks and other financial institutions to impose a cybersecurity levy on electronic transfers. This decision comes after President Bola Tinubu suspended the levy on May 14.

Earlier, on May 6, the CBN had directed all commercial, merchant, non-interest and payment service banks, mobile money operators, and payment service providers to charge a 0.5 percent cybersecurity levy on electronic transfers.

The deduction was meant to comply with the Cybercrime (Prohibition, Prevention, etc.) Amendment Act of 2024. The collected funds were to be remitted to the national cybersecurity fund, overseen by the Office of the National Security Adviser (ONSA).

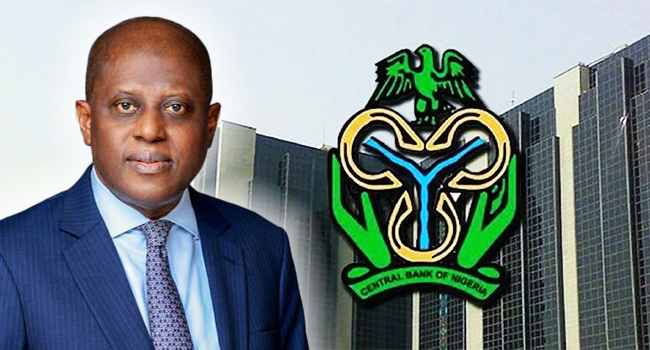

However, this directive was halted in a circular titled “Re: Cybercrimes (Prohibition, Prevention, ETC) (Amendment) Act 2024 — Implementation Guidance on the Collection and Remittance of the National Cybersecurity Levy,” dated May 17, and made public on May 19. The circular was signed by Chibuzo Efobi, Director of Payments System Management Department, and Haruna Mustafa, Director of Financial Policy and Regulation Department.

“The Central Bank of Nigeria circular dated May 6, 2024 (Ref:PSMD/DIR/PUB/LAB/017/004) on the above subject refers,” the CBN stated. “Further to this, please be advised that the above referenced circular is hereby withdrawn. Please be guided accordingly.”

The suspension by President Tinubu, which prompted the CBN’s withdrawal, came amid widespread criticism of the levy. The Nigeria Labour Congress (NLC) had vehemently opposed the directive, describing it as an additional burden on Nigerians. NLC President Joe Ajaero, on May 7, argued that such deductions would directly impact the disposable income of workers and reduce the purchasing power of ordinary citizens. He also highlighted the adverse effects on domestic manufacturers and businesses already struggling in a challenging socio-economic environment.